do nonprofits pay taxes on utilities

The rules can be complicated and there may be exceptions or exemptions that apply to your specific situation. Most nonprofits do not have to pay federal or state income taxes.

Houston Utility Assistance Find Help To Pay Your Light Bill 2021

Do nonprofits pay taxes.

. However here are some factors to consider when. Organizations granted nonprofit status by the Internal Revenue Service IRS are generally exempt from tax they must pay some types of taxes under certain. Employment taxes on wages paid to employees and.

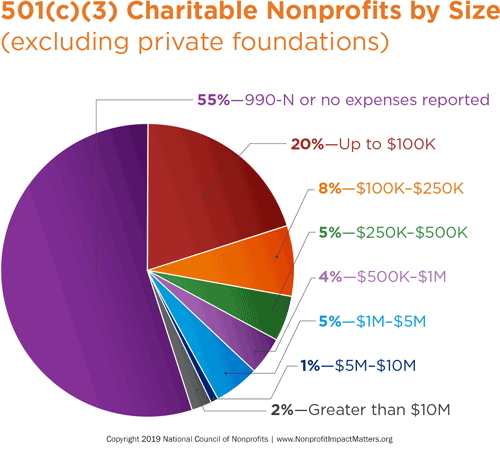

The IRS which regulates tax-exempt status allows a 501 c 3 nonprofit to pay reasonable salaries to officers employees or agents for services rendered to further the. 501c12 Tax exempt Income from memberships to 501c12 co-op utility providers is not considered UBTI and is tax exempt. For the most part nonprofits and churches are exempt from the majority of taxes that for-profit businesses are.

There are certain circumstances however they may need to. However this corporate status does not. Do nonprofits pay taxes on utilities Wednesday June 1 2022 Edit.

Services to General Public Taxable If your. In short the answer is both yes and no. Do nonprofit organizations have to pay taxes.

While most US. 2 Tax Issues Relating To Charitable Contributions And Organizations Everycrsreport Com Do Nonprofits Or. Certain nonprofit and government organizations are eligible for exemption from paying Texas taxes on their purchases.

The research to determine whether or not sales. 501c3s do not have to pay federal and state income tax. According to the Michigan tax code at the time of publication churches schools charities eligible hospitals and other nonprofit organizations are exempt from state sales tax on regulated.

Many but not all nonprofits are considered tax exempt which means that they are not required to pay federal corporate. UBI can be a difficult tax area to navigate for non-profits. Sadie is ready to get up to speed on paying payroll taxes.

Utility sales tax on items such as telephone gas electric or water that is used to further the tax exempt purpose for a nonprofit organization or government agency may be exempt from utility. But they do have to pay. Do nonprofits pay payroll taxes.

Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax exemptions. Taxes on money received. For the most part nonprofits are exempt from most individual and corporate taxes.

Below is a beginners guide intended for high-level determination of whether rental income is subject to unrelated. Nonprofit and Exempt Organizations Purchases and Sales. Your recognition as a 501c3 organization exempts you from federal income tax.

Nonprofit organizations that receive an exemption identification number E number from the Department are exempt from state sales and use tax when purchasing. Which Taxes Might a Nonprofit Pay. Yes nonprofits must pay federal and state payroll taxes.

For assistance please contact any of the following Hodgson. Whether or not nonprofits have to pay sales tax on taxable purchases depends on the state and local tax rules that apply to that transaction.

Myths About Nonprofits National Council Of Nonprofits

Misappropriating Nonprofit Funds A Look At Restricted Donations

Myths About Nonprofits National Council Of Nonprofits

Yes Tax Exempt Non Profits Must Pay Payroll Taxes

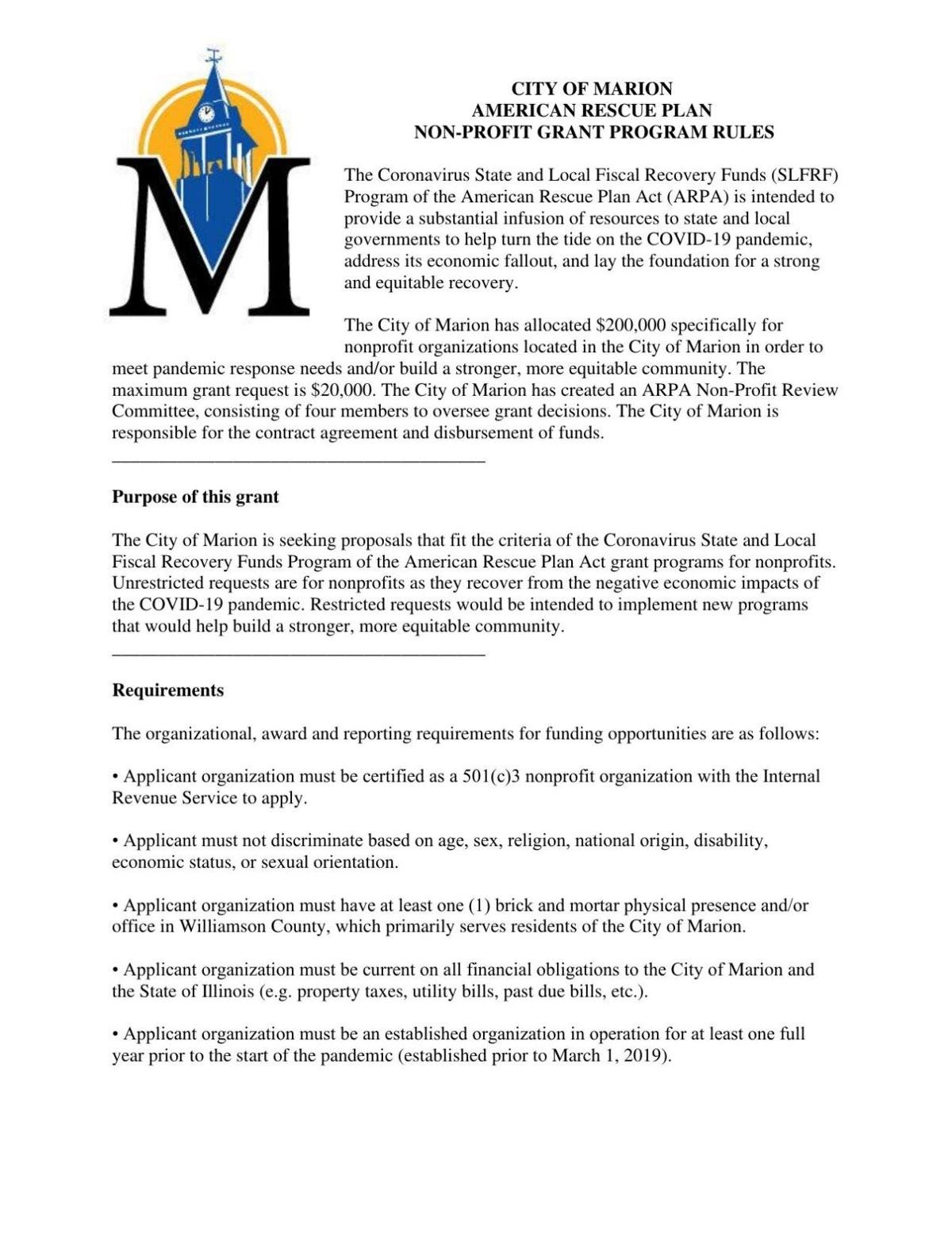

Marion Illinois Accepting Arpa Grant Applications From Local Nonprofits Span Class Tnt Section Tag No Link News Span Wpsd Local 6

Exelon Estimates It Will Pay 200 Million More Annually Under New Federal Tax Law Crain S Chicago Business

State Of Nj Department Of The Treasury Division Of Taxation Nonprofit Organizations

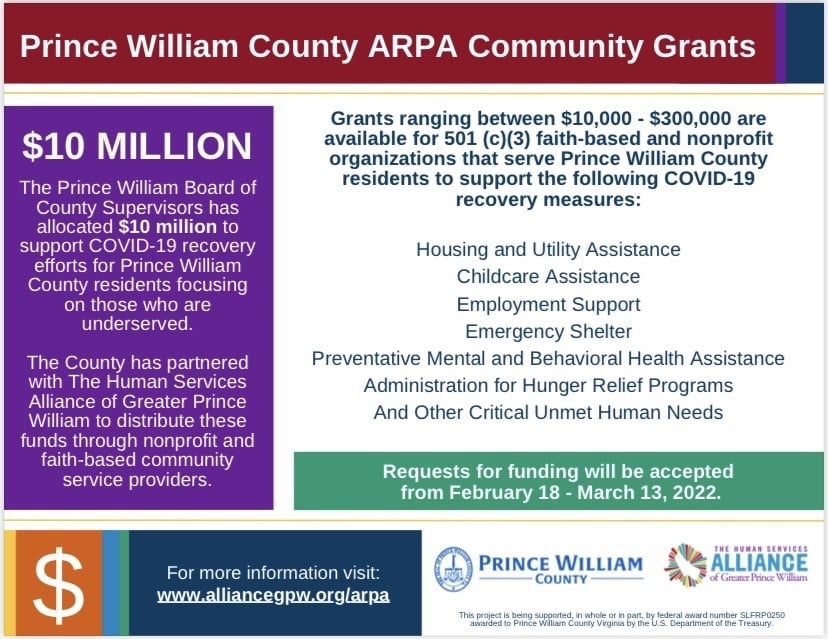

County Partners With Human Services Alliance To Support Covid 19 Recovery Efforts In The Community

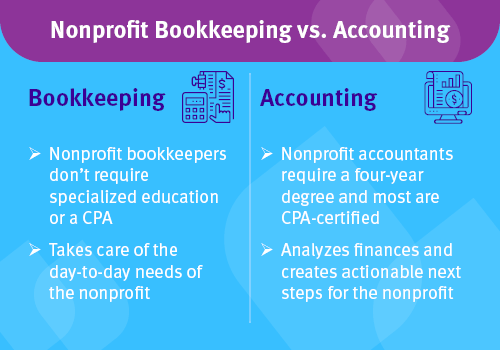

Nonprofit Bookkeeper Vs Accountant Who Should You Hire Jitasa Group

A Nonprofit Parking Tax Repealed Nonprofit Accounting Academy

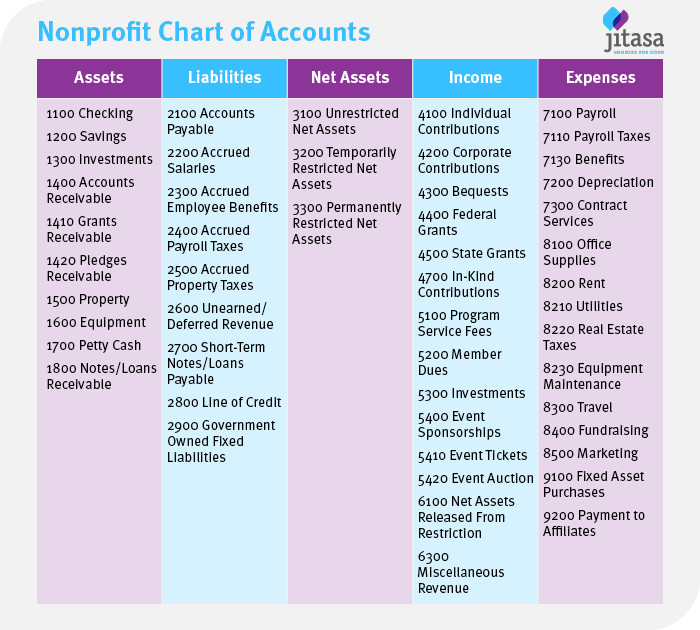

Establishing A Nonprofit Chart Of Accounts Jitasa Group

Would Non Profit Utilities Cure What Ails California Electricity Energy Institute Blog

Do Nonprofit Organizations Pay Property Taxes

Tax Exemptions For Energy Nania

How To Find Rent And Utility Assistance In Houston 2020

Solar For Nonprofits Schools Churches Credit Unions Charities

How Do Non Profit Business Owners Get Paid The Blue Heart Foundation